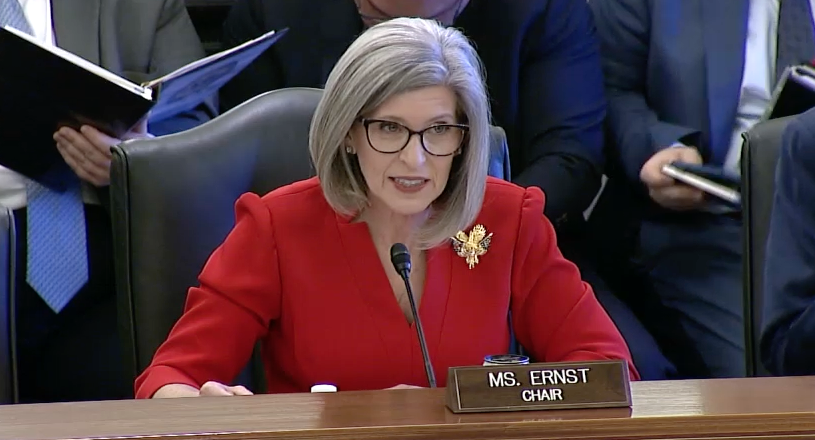

Chair Ernst Delivers Opening Remarks at 7(a) Loan Hearing

WASHINGTON – Today, at the Senate Committee on Small Business and Entrepreneurship hearing on the Small Business Administration’s (SBA) 7(a) loan program, Chair Joni Ernst (R-Iowa) detailed how the Biden administration’s loosening of rules and reckless expansion of the program increased the risk for American taxpayers.

Ernst highlighted how the actions of the previous administration opened the door to rising default rates and declining revenues that threaten to force taxpayers to foot the bill for the 7(a) program that has previously operated without subsidies.

Watch Chair Ernst’s full opening remarks here.

Ernst’s full opening remarks:

“Nearly two years ago, we met to discuss the reckless new rules the Small Business Administration (SBA) implemented for the 7(a) loan program.

“They removed time-tested underwriting standards that mitigated the risk of default for American taxpayers who guarantee these loans.

“These new rules also opened the door to foreseeable fraud by enabling a potentially unlimited number of unregulated, non-depository institutions to become permanently licensed SBA lenders as Small Business Lending Companies, or SBLCs.

“The last administration’s 7(a) rules were the most drastic changes to the program in decades, which is why members on a bipartisan basis voiced their concerns. Unfortunately, those concerns fell on deaf ears.

“I aggressively sought to understand how the SBA was selecting and approving these new SBLCs to participate in 7(a).

“The types of lenders the SBA was looking to license – fintechs – were responsible for facilitating widespread financial fraud and improper payments in the Paycheck Protection Program.

“I ask unanimous consent to enter into the record an April 24, 2024, letter that I sent with House Small Business Committee Chairman Williams to the SBA requesting information on the SBLC selection process. Without objection, so ordered.

“Two years later, we still have little insight. Even the recent SBA’s Inspector General (IG) report on the subject was woefully inadequate.

“The IG report stated the SBA followed its own procedures, but they failed to evaluate whether those procedures were adequate.

“The IG didn’t bother to investigate whether there was collusion between SBA officials and one of the largest applicants for a lending license, Funding Circle US.

“Nor did the report answer why the SBA and the IG concluded the cash position of Funding Circle US was sufficient, despite the fact that it was losing millions.

“The Biden SBA’s dangerous loosening of the underwriting and eligibility rules weren’t the only efforts to undermine the financial soundness of the 7(a) loan program.

“A year before the rule, the agency started to cut the fees charged to borrowers and lenders—fees meant to protect the taxpayer from having to subsidize bad loans.

“For three years straight, the SBA cut these fees, inexplicably allowing loans of up to one million dollars to be made without the borrower or lender having to pay for the guarantees the American taxpayer provided.

“As I said in a letter to President Trump on January 21st, the looming 7(a) fee increases are entirely due to the previous Administration’s incompetent management of the program, which has harmed taxpayers and the small businesses saddled with debt they can't manage, while irresponsible lenders get paid no matter what.

“I ask unanimous consent to enter this letter into the record. Without objection, so ordered.

“We are seeing the impacts of these rule changes, with the 12-month default rate more than doubling to roughly 3.2 percent since these rules went into effect, and defaults on loans less than 18 months old nearly tripling to almost one and a half percent over that same period.

“While the Biden-Harris SBA tried to blame this on rising interest rates, defaults on SBA loans have been increasing faster than those in the private sector, which is evidence of poor policy decisions.

“It should come as no surprise that for the first time in 12 years, 12 years, the 7(a) program lost money.

“This negative cash flow must be immediately addressed by reversing the misguided decisions of the past administration.

“This program was designed to operate with zero subsidy – and I worry we are on the cusp of forcing taxpayers to foot the bill, something we should avoid at all costs.

“I want to commend Administrator Loeffler for her recognition of these problems in her day one memo released this week and her willingness to hit the ground running.

“It is clear that the solvency of the SBA’s lending programs is a major priority for the Administrator, who has committed to doing what’s necessary to ensure their zero-subsidy status is secure.

“Today’s hearing provides an opportunity for us to speak with SBA participants to understand their concerns about the 7(a) program’s financial stability.

“It also allows the Committee to gather concrete suggestions on ways to reduce the risk faced by taxpayers while ensuring the program continues to be a resource for entrepreneurs who need assistance accessing capital.

“I’d like to thank our witnesses for being here today and I look forward to your testimony.”

###