Ernst Continues Bipartisan Work to Improve Child Care Access and Affordability

National day care and preschool costs are up nearly 5 percent since just last year.

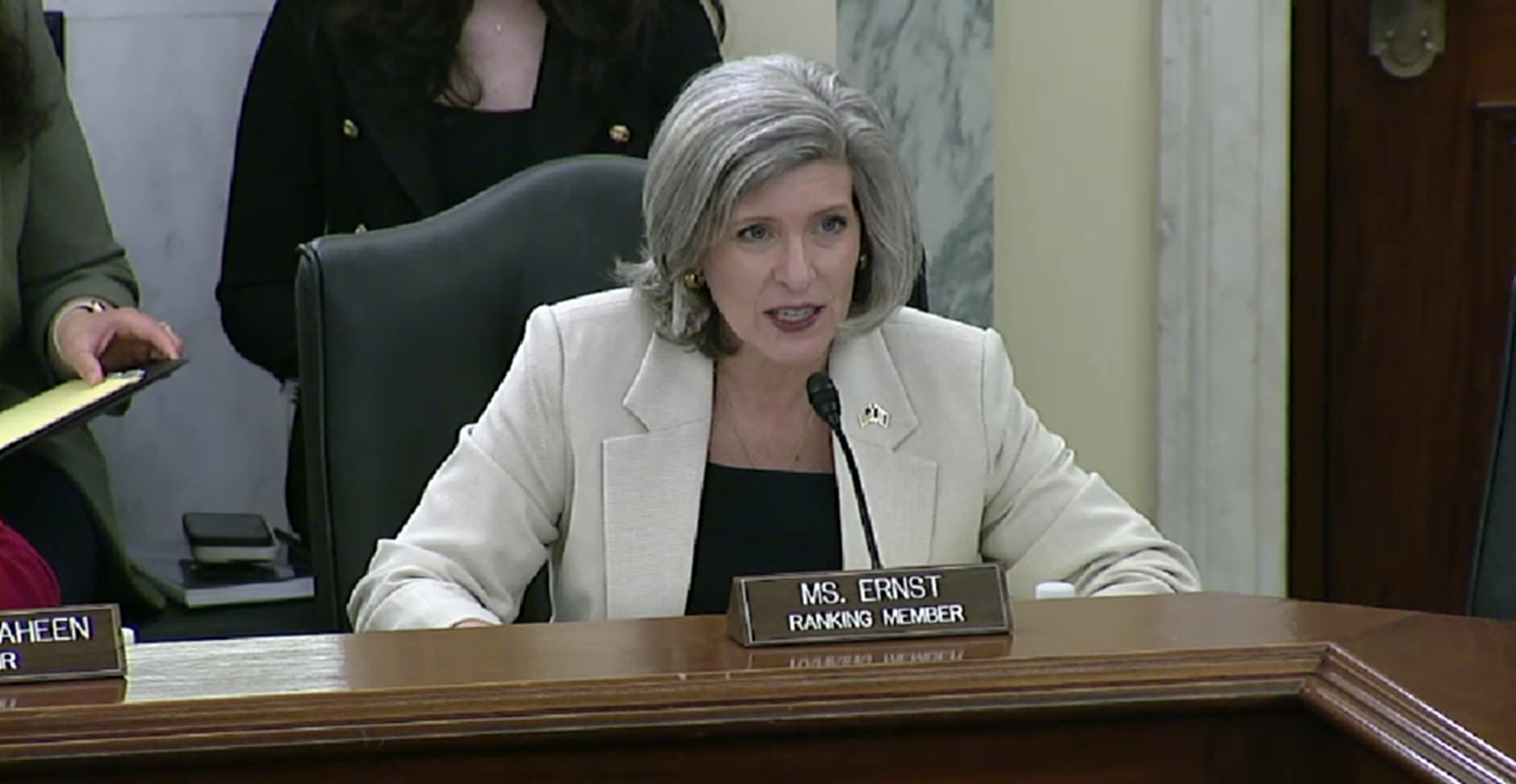

WASHINGTON — At today's hearing, U.S. Senator Joni Ernst (R-Iowa), Ranking Member of the Senate Small Business Committee, called out the Biden administration’s out-of-touch child care tactics which are hurting workers and small businesses. As a mother and new grandmother, Ernst urged the Small Business Administration (SBA) to pursue practical solutions to support families with small children, including bipartisan efforts like her Expanding Child Care in Rural America Act and Small Business Child Care Investment Act.

“Bidenomics and high costs of living have forced families to pay higher prices for child care, and as I travel from river-to-river across Iowa, I constantly hear from working families who need more child care options. In every one of our 99 counties, child care availability has a direct impact on our employers and economic growth.

“The answer to this challenge is not a Washington-driven, pricey, one-size-fits-all solution.

“I’m proud that Governor Reynolds is setting an example we can all learn from in Iowa! But at the federal level, commonsense fixes and a favorable regulatory environment can increase access to child care for working families and provide stability for our smaller providers. That’s exactly what I’ve long championed, and will continue to work on, especially for our rural communities,” said Ranking Member Ernst.

Watch Ernst’s opening remarks HERE.

At the hearing, Ernst also noted SBA’s glaring absence and failure to respond to her inquiry regarding the agency’s potential expansion of the 7(a) and 504 loan programs to nonprofit child care centers while excluding faith-based providers: “This is a major change that should not be made without congressional input. For that reason, I would have hoped to have the opportunity to speak with someone who works for the SBA about the specifics. But, despite outreach from my staff and I, SBA failed to specify whether they plan to include faith-based nonprofits. I fully intend to find out.”

Background:

The SBA currently offers multiple programs to help small businesses access capital, including the 7(a) program and the 504/Certified Development Company program. Through these initiatives, the SBA provides loan guarantees for small businesses that cannot acquire credit elsewhere. Currently, for-profit child care centers are eligible for these programs.

Ernst’s Child Care Small Business Investment Act would make non-profit child care providers eligible for 7(a) and 504 loan programs under the SBA, so long as they are licensed by the state and their employees have had criminal background checks. This legislation would also ensure that religiously-affiliated non-profits qualify for these loan programs. This effort passed through the Senate Small Business Committee in 2023 with bipartisan support.

Her Expanding Child Care in Rural America Act would give child care providers in rural agricultural communities the ability to access Department of Agriculture business development grants to prioritize projects that address the availability, quality, and cost of child care.

###