Ernst Slams Biden’s SBA for Requesting More Money While Failing to Protect Taxpayers

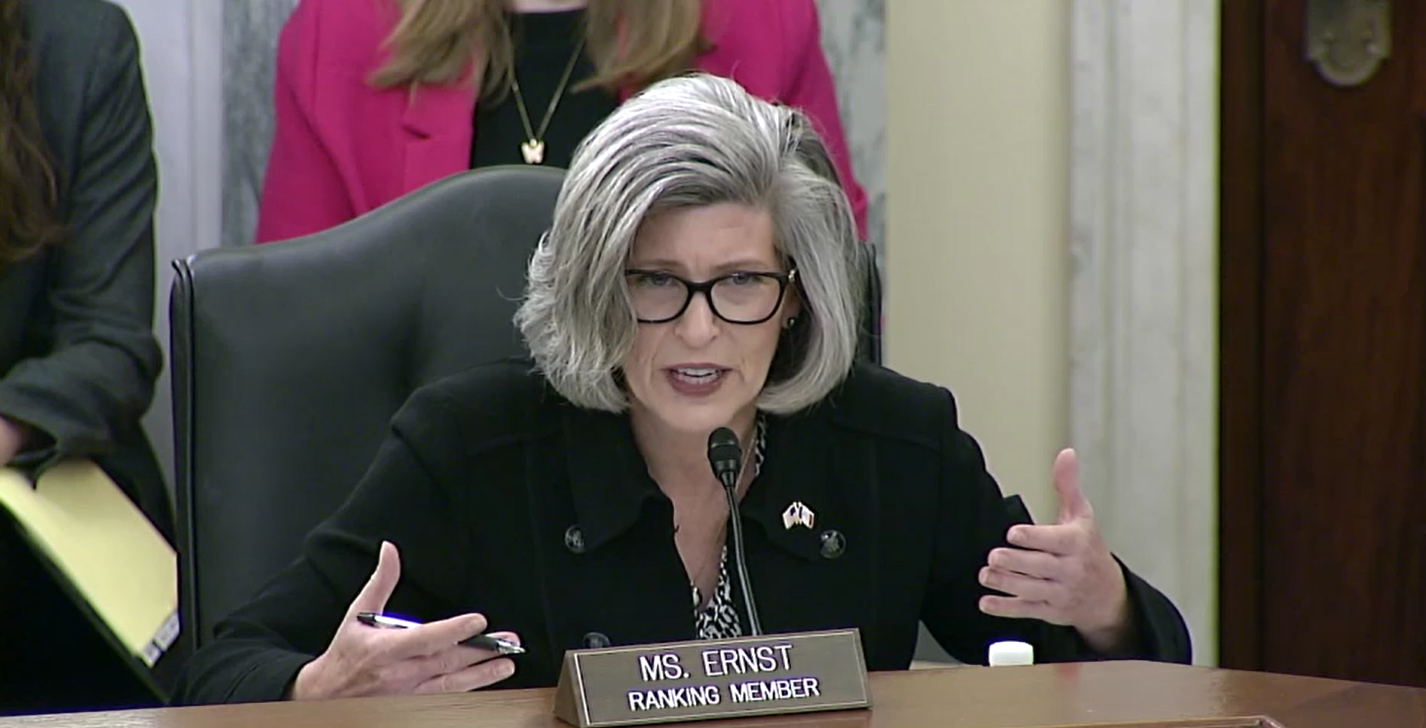

WASHINGTON – Today, U.S. Senator Joni Ernst (R-Iowa), Ranking Member of the Senate Small Business and Entrepreneurship Committee, questioned Small Business Administration (SBA) Administrator Isabel Guzman about President Biden’s funding request and the agency’s ongoing failures to protect taxpayer dollars. Ernst demanded that the SBA fix its major problems before asking for more money from Americans.

During Ernst’s questioning, Guzman agreed to reassess the SBA’s due diligence on its conditional Small Business Lending Company (SBLC) license to foreign-linked Funding Circle. Administrator Guzman also stated on the record that the SBA will not restart a 7(a) direct loan program without additional congressional authority.

“Administrator Guzman, you are here today asking for more money to fund an agency that is actively failing to respond adequately to numerous inquiries from Congress, actively failing to track fraud in its programs, and whose offices are often deserted. GAO reports that your headquarters has only a nine percent utilization rate,” said Ranking Member Ernst. “The American people are so sick of Washington wasting their hard-earned money, and the SBA’s recklessness is a testament to the larger problems of Biden’s mismanaged government.”

Watch Ernst’s opening remarks here.

Ernst also questioned Guzman on the SBA’s decision to give financial technology companies, or fintechs, unlimited access to a key SBA program while reducing the underwriting requirements that protect American taxpayers.

Watch here.

Ernst noted that one of the first licenses awarded under SBC’s new rules was to a London-based company called Funding Circle, whose current U.S. Managing Director is the former COO of the fintech Bluevine, a company that aided in issuing fraudulent PPP loans. She also pointed to reports indicating that Funding Circle has an investment from a Bejing-based fintech conglomerate.

“It’s not clear whether the SBA knew it was giving access to loans, guaranteed by American taxpayers, to a company partially owned by the Chinese,” said Ernst. “Based on the SBA’s recent track record, I have zero confidence in the agency to do proper due diligence on SBLC risk and protect programs from CCP influence. I join my colleagues in demanding the administration rein in its reckless lending rules and stop issuing new licenses like the one they issued to China-affiliated Funding Circle.”

Ernst also pointed to the SBA bucking precedent.

“Funding Circle announced yesterday that they plan to start making SBA loans as early as April. Meanwhile, Funding Circle’s CEO states they don’t have sufficient capital to make SBA loans and are looking to sell.” Ernst continued, “The SBA, as far as we know, has never granted a license to a company that intends to immediately turn around and sell the license.”

Background:

Ernst has long fought to bring accountability to the SBA and safeguard taxpayer dollars.

In May 2023, Ernst asked SBA to delay the implementation of lending rules until permanent leadership can be established at the SBA Office of Capital Access. Her bipartisan, bicameral letter has gone unanswered by the Administration.

In June 2023, Ernst renewed her calls for the SBA to strengthen lending standards. In November 2023, Ernst released her Small Business COVID-19 Fraud: Three Years Later State of Play report, where she outlined the Biden SBA’s effort to discount the full extent of COVID-era fraud and cast doubt on the legitimate estimates made by expert investigators.

In December 2023, Ernst exposed that Biden’s SBA is utilizing just nine percent of its headquarters maintained on the taxpayer’s dime and called on Administrator Guzman to increase the transparency of SBA’s telework policies, locality pay, unused office space, and taxpayer-funded union time payments.

In March 2024, Ernst called out negligent bureaucrats at the SBA for failing to comply with an Ernst-authored transparency law.

###